*EIN Newswire / SiliconAngle / Dave Vellante

When a piece of digital art sells for $69. million, more than has ever been paid for works by Paul Gauguin or Salvador Dali, and makes its creator the third most expensive living artist in the world, one can’t help but take notice and ask: “What is going on?”

The latest craze around nonfungible tokens, or NFTs, may feel a bit bubblicious, but it’s yet another sign that the digital age is now fully upon us. In this Breaking Analysis we want to take a look at some of the trends that may have observers and investors scratching their heads, but we think still offer insight to the future — and possibly some opportunities for young investors. And we’ll briefly touch on how these trends may relate to enterprise tech.

Beeple is now the hottest artist on the planet

That’s Beeple‘s Twitter profile picture on the inset in the picture above. His name is Mike Winkelmann. He’s actually a normal-looking dude, but that’s the picture he chose for his Twitter.

This collage reminds one of the Million Dollar Homepage. You may already know the story but back in 2005 a college kid from England named Alex Tew created the Million Dollar Homepage to fund his education. His idea was to build a Website with a million pixels and sell ads at a dollar for each pixel. Guess how much he raised? $1 million right? Wrong! $1,037,100. How so? Well he auctioned off the last 1,000 pixels on eBay and fetched $38,000. Crazy, right?

Well, maybe not. It’s pretty creative and a way early sign of things to come.

Quick summary of NFTs

We’re not going to go deep into NFTs and explain the justification behind them. There’s tons of material published that can do justice to the topic better than we can, but here are the basics.

NFTs stand for nonfungible tokens. They’re digital representations of assets that exist on a blockchain. Each token has a unique and immutable identifier using cryptography to ensure authenticity.

NFTs are not fungible unlike bitcoin, Ethereum or other cryptocurrencies, which can be traded on a like-to-like basis. In other words, if we each own 1 BTC we know exactly how much each of our bitcoins is worth. Nonfungible tokens each have their own unique value, so they’re not tradable on a like-to-like value basis.

What’s the point of this? Well NFTs can be applied to any property – identities, tweets, videos, collectibles, digital art, pretty much anything. It’s really unlimited. NFTs can also streamline transactions and can be bought and sold very efficiently, without the need for a trusted third party. The other benefit is the probability of fraud is reduced.

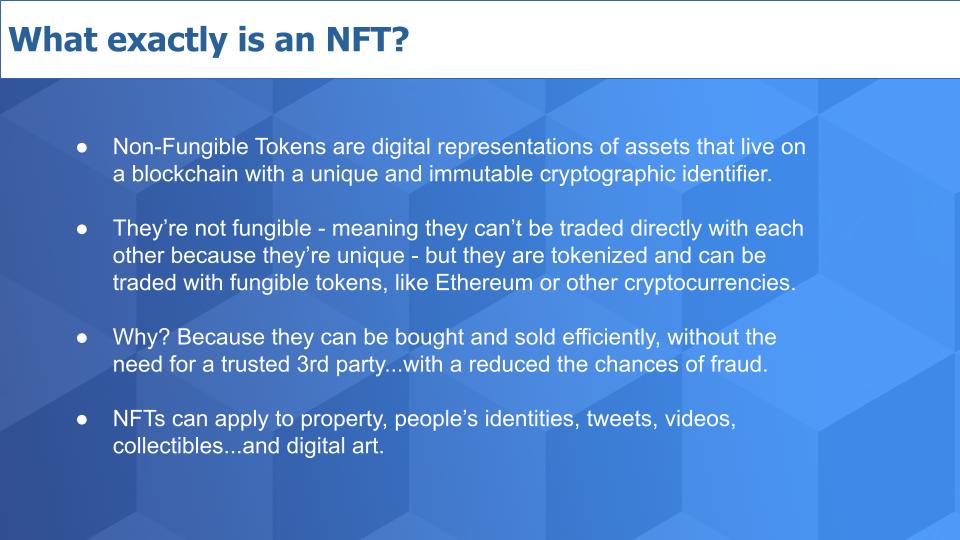

How investors think about asset choices

NFTs, along with cryptocurrencies, are an emerging and increasingly important asset class. Rather than try to justify these emerging investment types, we want to talk about the choices that investors have in the market today.

Recently we were in a discussion with Jay Po, who is a principal and co-founder at Stage 2 Capital. He’s a former Bessemer VC and one of the sharper investors in the software-as-a-service market. He was talking about the choices that investors have and how they make those choices, and he gave a nice example that we think can be instructive our investor audience.

As an investor, you have alternatives. We’re showing in the chart above three choices with their respective valuations as of March 12, plus their year-to-date charts.

Choice No. 1: Amazon

As an example, you can buy Amazon’s stock. If you bought just about a year ago you did really well and saw a return of 80% or more. But if you want to jump in today, your mindset might be somewhat different. You may think to yourself, “Amazon is going to be around for a long time and I like the stock but and I’m probably going to get a 10-15% annual return over the long term. Maybe less. Maybe more, but it’s unlikely that in any reasonable timeframe Amazon will go out of business. On the other end of the spectrum, it’s also less likely that you’ll get a 10X return. In order to get that type of return on invested capital, Amazon would have to become a $16 trillion company.”

So you consider, what’s the probability that Amazon goes out of business – pretty low, right? And what are the chances that it becomes a $16 trillion company over the next several years? Well, it’s probably more likely that it continues to grow at a more stable rate. And that frames the asset in your mind.

Choice No. 2: Snowflake

Now let’s talk about Snowflake. We’ve covered the company extensively. We watched Snowflake grow from early-stage startup and then saw its valuation increase steadily as a private company. But even early last year its value was around $12 billion, and as late as mid-September, right before the IPO, news hit that Marc Benioff and Warren Buffett would put $250 million each into the company. With that news, it was projected that Snowflake’s valuation could go over $20 billion with an $80 to $85 opening price.

Lo and behold, on day one after the IPO Snowflake was worth more than $50 billion. The stock opened at $120, but unless you “knew a guy” or got in on friends and family, you had to hold your nose and buy it on day one and maybe got it at $240 or $250 or even higher. At the time, we said you’d likely get a better price than day one. The stock closed at $230 on March 12.

But you look at Snowflake today and if you want to buy, you may think to yourself, “I like the company, it’s probably still overvalued, but I can see the company’s value growing substantially over the next several years – maybe doubling in the near to midterm. I mean, it hit more than $100 billion in value back as recently as December, so that’s feasible. The company is not likely to flame out, but because it’s highly valued, I might have to be patient for a couple years, but I like the management and the company. Maybe the company gets into the $200 billion range over time and I can make a decent return.”

But to get a 10X return, Snowflake would have to hit a valuation more than $500 billion and become one of the next great software companies of our time. OK, what’s the likelihood of that? As an investor you have to evaluate that probability. It’s maybe more probable in your mind that Snowflake runs into competition or the market shifts and maybe the company gets into the $200 billion range, but it really has to transform an industry and execute for you to get in today and get a 10X return.

So you frame Snowflake’s risk-reward profile and that helps you make the decision.

Choice No. 3: crypto

Now let’s take a look at a different asset and that’s a cryptocurrency called Compound. Compound is a decentralized protocol that allow you to lend and borrow cryptocurrencies. Now we’re not saying to go out and buy Compound, but just as a thought exercise: Here’s an asset with a lower valuation with possibly much higher upside – but at much higher risk. For Compound to get a 10X return, it has to get to a $20 billion valuation.

What are the chances compound flames out or the lending craze dries up or somehow the advantages Compound investors are seeing today change when the market shifts? Well, that’s a much higher probability than Amazon or Snowflake going to zero.

But perhaps there’s more upside as well. Now, maybe Compound isn’t the right asset or your cup of tea, but there are many cryptos that have made it to valuations of $20 billion, and if you do your research, you could find a project that’s much earlier stage that, yes, is higher-risk, but has much higher upside.

So this is a very simplified example of some of key factors investors consider. Most investors look at their choices in this context before making decisions. And the more sophisticated investors use detailed metrics and analyze things such as multiple on invested capital, internal rate of return, total addressable market analysis, competition, detailed company models and so forth.

Crypto and NFTs democratize access to core innovation investments

One of the things we really want to explore — and we brought this up at the Snowflake IPO — is the lack of access for the everyday investor. If you were Buffett or Benioff and had $250 million, you could get an almost guaranteed return with your late-in-the-game but pre-IPO Snowflake investment. Or if you were venture capital investor Mike Speiser or one of the earlier VCs or even someone such as Jeremy Burton who was part of the insider network, you could get cheap stock and get a 5X, 10X, 50X or even north of 100X return like the early VCs who took a big risk and helped build the company.

But chances are you’re not in one of these categories. So how can you, as a small player, participate in something big?

You might remember at the time of the Snowflake IPO we showed you this picture:

Who are these people? Olaf Carlson-Wee, Chris Dixon, Sonal Chikoshi and of course World Wide Web inventor Tim Berners-Lee. But these are some of the folks that are deeply involved in and have inspired many to pay attention to crypto. The premise that caught our attention was the following.

Think about the early days of the internet. If you saw what Berners-Lee or Linus Torvalds were working on and wanted to invest in the internet, you really couldn’t. You couldn’t invest in Linux or TCP/IP or HTTP. You could have invested in Cisco Systems Inc.after its IPO and that would have paid off big time for sure. Or you could have waited for the Netscape Communications Inc. IPO – but the core infrastructure of the internet fundamentally was not directly a candidate for investment by you, the little person.

And as Microsoft Corp. Chief Executive Satya Nadella said the other day, we have reached maximum centralization. The main protocols of the internet were largely funded by the government but have been co-opted by the giants and have been largely centralized from a control standpoint.

But with crypto you actually can invest in core infrastructure technologies that are building out a decentralized internet. A new internet. It’s a big part of the investment thesis behind what Carlson-Wee is doing, and Andreessen Horowitz has two crypto funds and has collectively raised more than $800 million to invest. And you should read the firm’s crypto investment thesis. And maybe take their crypto startup classes.

Consider this. Go to any large VC’s website and look at its portfolio of private companies. How can you as a small investor get in? Let’s say, for example, you really like the new Clubhouse app and want to invest. Well, you have to have enough juice and cash to get into the deal directly, or become a limited partner of a VC firm, or wait for the IPO, after the valuation has already skyrocketed.

But scan the Andreessen Horowitz crypto portfolio and you can actually invest in many of the assets directly from your favorite crypto exchange — with short money.

One person in the picture above whom we haven’t mentioned Camila Russo. She is a journalist turned hardcore crypto author and is doing a great job explaining the white hot DeFi market –that stands for decentralized finance. Read her work and educate yourself if you’re interested in learning more about the future and perhaps finding some 10X or even 100X opportunities.

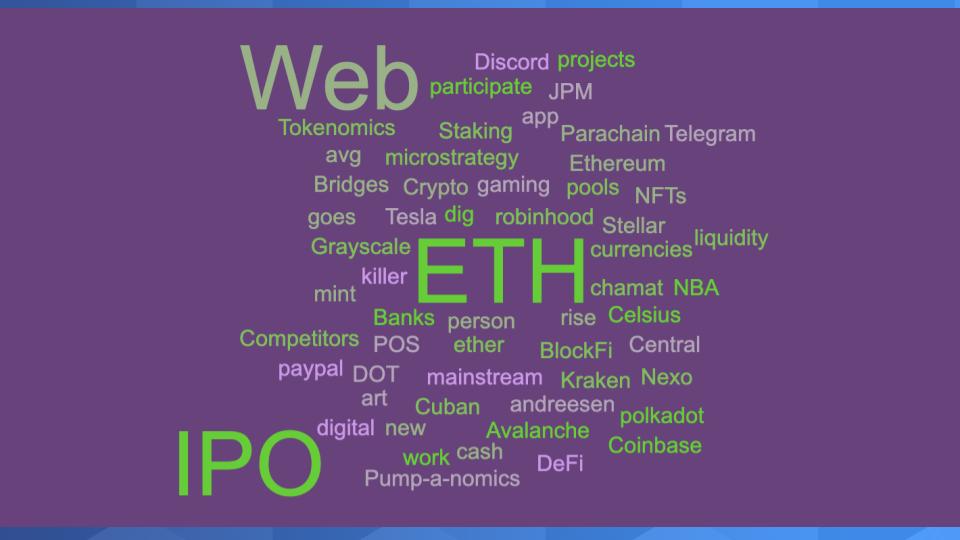

Crypto innovation goes mainstream

There is real tech being developed at the intersection of cryptography, software engineering and game theory.

You can listen to Warren Buffett and Janet Yellen, who imply this will all end badly. Yes, there is fraud and some bogus pump-and-dump schemes happening – no doubt. That’s why you have to be careful. But although these individuals are smart people, they would not be our recommended go-to source on understanding the potential of blockchain technology, crypto innovations and the future that’s coming.

The innovations are mind-boggling and the word cloud above takes a snapshot of some of the projects that catch our attention.

We’ve talked above a bit about NFTs.

DeFi is one of the most interesting and disruptive trends to fintech. Celsius, Nexo and BlockFi, which lets the average person participate in liquidity pools are all worth researching.

Crypto is going mainstream

There are several examples: Tesla Inc., MicroStrategy Inc. and Square Inc. put Bitcoin on their balance sheets. In 2017, Jamie Dimon called Bitcoin a tulip bulb-like fraud, yet JPMorgan Chase & Co. just announced a structured investment vehicle to give its clients a basket of stocks with exposure to crypto. PayPal allowing customers to buy, sell and HODL crypto. You can trade crypto on Robinhood Market Inc. Central banks are talking about launching digital currencies and why not? Coinbase Global Inc. is doing an IPO that will give it a value of $100B – wow – sounds frothy – but still.

Big names such as Mark Cuban and Chamath Palihapitiya have been active in crypto for a while. Gronk is getting into NFTs and so it does have that bubble feel to it. But often when tech bubbles burst, they shake out the pretenders, and if there’s real tech involved, some contenders emerge as dominant players.

There is a new web being built out, so if you want to participate, do some research. Figure out how polkadot works. Make a call on whether you think Avalanche is an Ethereum killer. Dig in and find out about the new projects, form a thesis and you may, as a small player, be able to find some big winners.

But you do have to be careful. There was a lot of fraud in the initial coin offering craze (there’s your risk), so understand the tokenomics and maybe as importantly the pump-a-nomics, because they certainly loom as dangers. This is not for the faint of heart, but because we believe it involves real tech, we like it way better than Reddit-driven stocks.

Not to diss Reddit – there’s some good information on Reddit if you’re patient and can find it. And there’s lots of good information flowing on Discord and people are flocking to Telegram as a hedge against big tech/big brother watching.

Maybe this all sounds crazy. And you know what? If you’ve grown up in a privileged household and have a U.S. education, maybe it is nuts and too risky for you. But if you’re one of the many people who haven’t been able to participate in elite circles, there are things going on, especially outside the U.S., that are democratizing investment opportunities, and we think that’s pretty cool.

Just be careful.

Blockchain in the enterprise

So this Breaking Analysis is a bit off topic from our typical focus and Enterprise Technology Research survey analysis, so let’s bring this back to the enterprise– because there’s a lot going on there with blockchain.

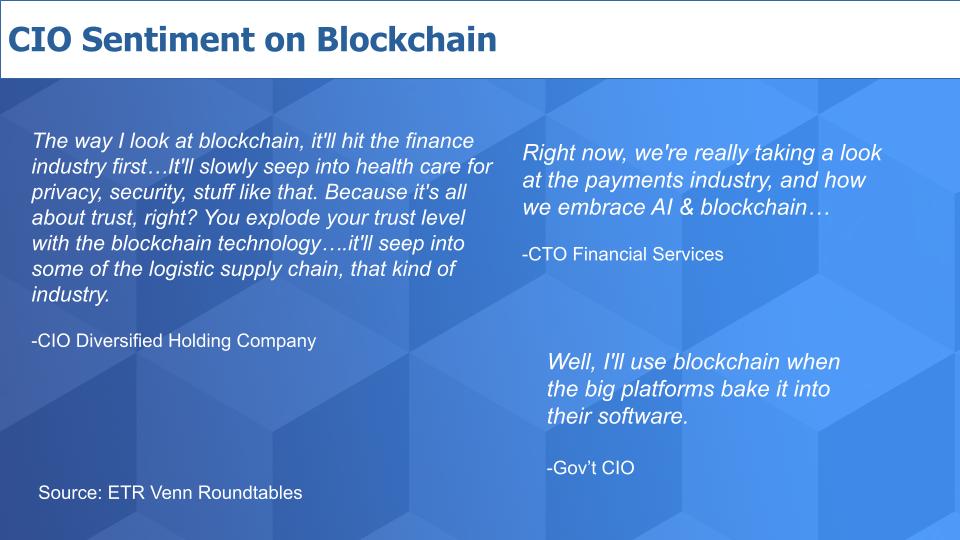

Let’s first share some quotes on blockchain from a few ETR VENN roundtables.

The first comment is from a chief information officer at a diversified holdings company who says correctly that blockchain will hit the finance industry first, but there are use cases in healthcare given the privacy and security concerns — and logistics to ensure provenance and reduce fraud.

And to that individual’s point about finance – the chief technology officer of a major financial platform said, “We’re really taking a look at payments” – do you think traditional banks will lose control of payment systems? There are some real disruption possibilities.

And this last comment from a government CIO, who says, “We’ll wait until the big platform players bake it into their software.”

And that is happening. Oracle Corp., IBM Corp., VMware Inc., Microsoft, Amazon Web Services Inc. and Cisco all have blockchain initiatives going on. Now, by the way none of these tech companies wants to talk about crypto; indeed, they try to distance themselves from that topic, which is understandable. But the truth is there’s way more investment and innovation going on in crypto than within enterprise tech companies at this point, and we predict that the crypto innovations will absolutely be seeping into enterprise tech players over time.

But for now, the cloud players want to support developers building out this new internet. The database is a logical place to support immutable transactions, which allow people to do business one-on-one and have total confidence that the source hasn’t been hacked or changed. And we’re seeing infrastructure build-outs to support smart contracts. The use cases in the enterprise are endless: asset tracking, data access, food tracking, maintenance, KYC/know your customer, telecoms, oil and gas, and on and on.

The NFT craze is a signal. Don’t ignore it

NFTs are a sign. Crypto craziness is a signal as to how information technology and other parts of companies – and their data – might be organized, managed, tracked, protected and valued in the years ahead. Today it’s memes and CryptoKitties, art and of course money – the killer app for blockchain. But in the future, the underlying technology of blockchain and the many percolating innovations around it could become – will become – a fundamental component of a new digital economy.

So get on board, do some research and learn for yourself. But be careful out there!

Keep in touch

Remember these episodes are all available as podcasts wherever you listen. Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.